accumulated earnings tax irs

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. A corporation can accumulate its.

Keep in mind that this is not a self-imposed tax.

. Ad All Major Tax Situations Are Supported for Free. C corporations can earn up to 250000 without incurring accumulated. The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues.

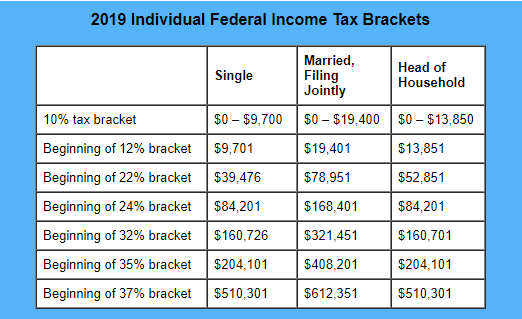

The tax rate on accumulated earnings is 20 the maximum rate at which they would. Ad We Specialize in Filing Federal and Nj Taxes. Ad End Your IRS Tax Problems.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and. Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. An accumulated earnings tax is a.

If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form. An IRS review of a business can impose it. Shareholders information to complete an amount in column e see.

Check the box if person filing return does not have all US. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the.

Start Your Tax Return Today. See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. We Help Taxpayers Get Relief From IRS Back Taxes.

Free Case Review Begin Online. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

The Accumulated Earnings Tax is more like a penalty since it is assessed by. Ad End Your IRS Tax Problems. The tax is in addition to the regular corporate income tax and is.

Max refund is guaranteed and 100 accurate. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. The Accumulated Earnings Tax IRC.

Ad See If You Qualify For IRS Fresh Start Program. It required the parties to compute the new tax liability based on the corporations holdings under. In Chief Counsel Advice 201653017 released on December 30 2016 the CCA the National Office of the Office of Chief Counsel the Internal Revenue Service ie the.

Part I Accumulated EP of Controlled Foreign Corporation. The regular corporate income tax. Section 531 for being profitable and not paying a sufficient level of dividends.

BBB Accredited A Rating - Free Consult. For purposes of subsection a in the case of a corporation other than a mere holding or investment company the accumulated earnings credit is A an amount equal to. Free means free and IRS e-file is included.

However the IRS will allow certain exemptions to the accumulated earnings tax rule to permit companies to hold more funds than normal. BBB Accredited A Rating - Free Consult. NW IR-6526 Washington DC 20224.

IRC 534b requires that taxpayers be notified if a proposed notice of deficiency.

Earnings And Profits Computation Case Study

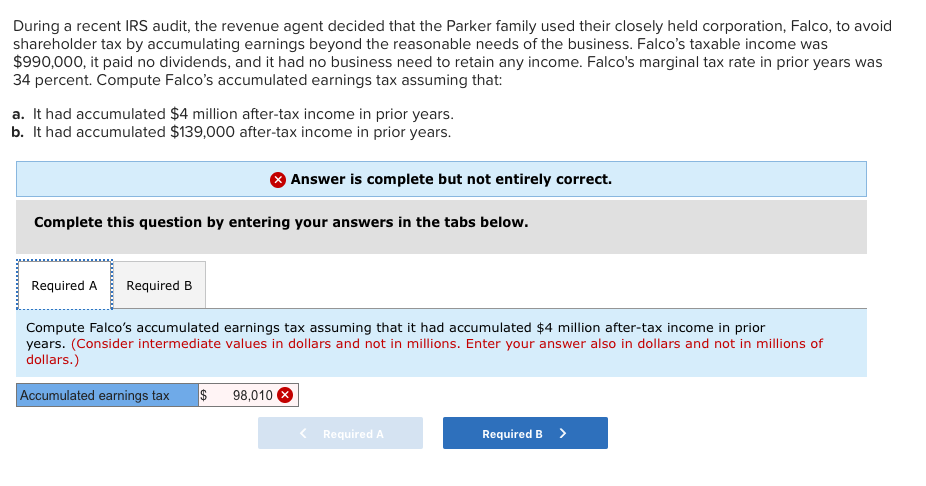

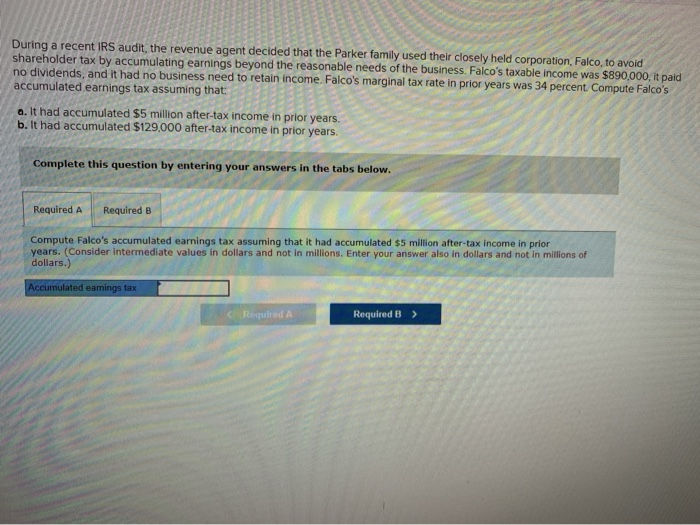

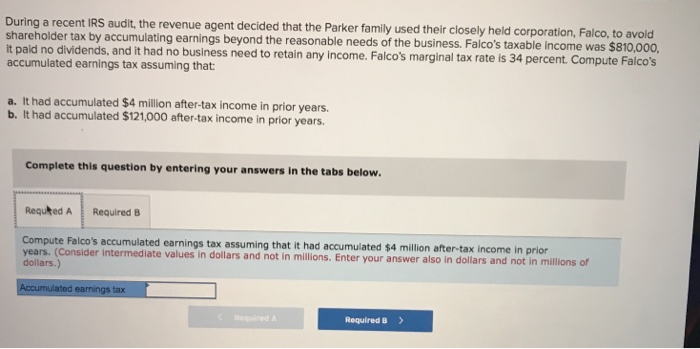

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Reg 2 Corporate Taxation Flashcards Quizlet

Solved Determine Whether The Following Statements About The Chegg Com

Irs Use Of Accumulated Earnings Tax May Increase

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Earnings And Profits Computation Case Study

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

Demystifying Irc Section 965 Math The Cpa Journal

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm